|

The Denver Gazette on March 28 highlighted concerns over a bill aimed at limiting evictions without a substantial reason, emphasizing that its basis seems more anecdotal than analytical. This legislation restricts evictions to specific causes such as rent non-payment, plans to sell the property, lease violations, substantial property repairs, or property damage by the tenant. However, it introduces the possibility for tenants to legally challenge evictions, raising disputes over their validity. Recent legislative sessions in Colorado have aimed to bolster tenant protections in response to the escalating affordable housing crisis in Denver and statewide. House Bill 24-1098 seeks to clarify "just cause" for evictions, raising concerns that economic interventions by politicians often result in unintended consequences for those they intend to help. Critics argue that such regulations elevate operational costs for landlords, potentially leading to higher rental prices due to the bill's implications. Furthermore, the legal background of many state legislators is seen as a factor likely to encourage litigation, with tenants increasingly turning to lawsuits to avert eviction. The editorial also references Senator Nick Hinrichsen, D-Pueblo, who shared an anecdote about a 67-year-old constituent's alleged retaliatory eviction following complaints about inadequate heating, alongside other eviction scenarios involving personal disputes or political disagreements, though these instances lack substantial evidence and appear to be infrequent. With the introduction of House Bill 24-1098, tenants who have either fallen behind on rent for several months or have a history of property damage may now claim their eviction is retaliatory. This legislation allows for legal challenges to eviction causes, potentially halting the eviction process and enabling tenants to remain in their homes pending court decisions. This development is seen as undermining property owners' rights and could lead landlords to raise rents in an already expensive market. As the House and Senate prepare to reconcile different versions of the bill on April 2nd, constituents are encouraged to share their opinions with their representatives and senators, highlighting their stance on House Bill 24-1098 and the broader issues it raises concerning tenant rights and housing affordability. Full Bill can be reviewed by clicking here.

Jennifer Mussato is president at Denver-based First and Main RE powered by KW Commercial, a real estate group that specializes in land, acquisitions, dispositions, commercial leasing, and investment strategies.

0 Comments

The self-storage industry has a positive financial outlook and is expected to continue growing in the future. The industry has been relatively recession-resistant, as people continue to need storage space even during economic downturns. Additionally, the growing population and urbanization, as well as the rise of e-commerce, are expected to drive demand for self-storage in the future.

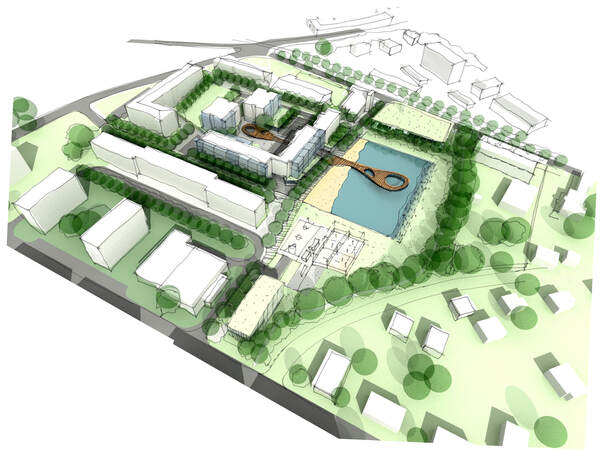

Revenue for the industry has been steadily increasing in recent years and is projected to continue to grow in the future. According to the Self-Storage Association (SSA), the industry's total revenue was $38.2 billion in 2019, and is projected to reach $44.8 billion by 2024. The industry is also characterized by a high occupancy rate, with the average occupancy rate being around 90%. The industry is also becoming more popular among institutional investors, which is helping to drive growth. Many REITs (Real Estate Investment Trusts) are now investing in self-storage facilities, which is providing a steady stream of capital for the industry. This is in turn helping to drive the construction of new facilities and the expansion of existing ones. Overall, the self-storage industry has a positive financial outlook, with steady revenue growth and high occupancy rates. The industry is expected to continue growing in the future as more people seek out convenient and flexible storage options. For investors looking to expand their portfolio, or just breaking into this market on a national level, please reach out for more information contact Wes Shattuck with First and Main RE. [email protected] #selfstoragefacility #selfstorageinvesting #realestateinvesting From Concept to Reality: The Land Development Process ExplaineD Part 2 - The conceptual plan2/15/2023 The conceptual plan is an important part of the land development process, as it provides a high-level overview of the proposed development and helps to identify any potential issues that may arise during the project. Here are some of the key elements that typically go into a conceptual plan:

Are you looking to develop a piece of land for commercial or residential use? Look no further than the land experts at First and Main RE. Our ultimate goal is to help you maximize the potential of your land and achieve a strong return on your investment. Author: Jennifer MussatoJennifer Mussato is a seasoned land specialist and the President at Denver-based First and Main RE powered by KW Commercial, a real estate group that specializes in land, acquisitions, dispositions, commercial leasing, and investment strategies. From Concept to Reality: The Land Development Process Explained Part 1 - Phases of Development1/26/2023

The land development process typically involves several phases, which can vary depending on the specific project and the jurisdiction. Here are some common phases in land development:

Are you looking to develop a piece of land for commercial or residential use? Look no further than the land experts at First and Main RE. Our ultimate goal is to help you maximize the potential of your land and achieve a strong return on your investment.

Q: Where can I apply for an SBA disaster loan? There are three ways to apply for an SBA disaster assistance loan. The SBA operates an online portal where you can upload business documents and apply for a loan. You can also fill out the PDF documents linked on the agency’s website and mail them to SBA’s processing and disbursement center at 14925 Kingsport Rd., Fort Worth, Tex., 76155-2243. The agency’s forms say applicants can also submit forms in person at an SBA disaster center but it is unclear which locations are open. Q: Who qualifies for these small business loans? Businesses in any U.S. state with fewer than 500 employees who are unable to pay their bills because of the coronavirus pandemic. Q: How long will it take? After you submit an application, the SBA will review your credit before conducting its own inspection to verify your losses. This includes reviewing any insurance recoveries you may have. The agency can issue you a loan while recoveries are pending. The SBA says its goal is to arrive at a decision on any disaster loans within two to three weeks. If it determines you are eligible, it will send you a loan closing document for your signature. An initial disbursement of $25,000 will arrive within five days, according to SBA informational materials. The rest of your loan will be disbursed on a schedule until you receive the full amount. The schedule will be set by an SBA loan officer whose job is to ensure you meet all the loan conditions. Q: How much can I get through an SBA disaster loan? Small businesses, small agricultural cooperatives or private nonprofit organizations can borrow up to $2 million for “economic injury,” meaning the organization cannot pay its ordinary and necessary operating expenses because of the coronavirus pandemic. President Trump has declared the coronavirus pandemic a national emergency. Q: What will the interest rate be? Interest rates on these loans are 3.75 percent for small businesses and 2.75 percent for nonprofits. Q: What information will I be asked to provide? Loan applicants are asked to provide a transcript of your most recent tax return and a tax information authorization form, a detailed accounting of your personal assets, sources of income and unpaid taxes. Those additional forms and instructions are posted here on the agency’s website. You will also have to include names and personally identifiable information for all proprietors, partners or stockholders who own at least 20 percent of the business. Nonprofit organizations can substitute tax returns for the organization’s IRS tax-exempt certification along with complete copies of the organization’s statement of activities. Q: What if I haven’t filed my taxes yet? In lieu of a tax return, the SBA asks for a year-end profit-and-loss statement and balance sheet for that tax year. POSTED BY: JENNIFER MUSSATO Jennifer Mussato is president at Denver-based First and Main RE brokered by Keller Williams, a real estate group that specializes in commercial leasing, acquisitions, dispositions and investment strategies.  A 1031 Tax Deferred Exchange offers taxpayers one of the last great opportunities to build wealth and save taxes. By completing an exchange, the Taxpayer (“Exchanger”) can dispose of investment or business-use assets, acquire replacement property and defer the tax that would ordinarily be due upon the sale. 1031 refers to section 1031 of Internal Revenue Code. A 1031 Exchange allows people to defer Federal capital gains tax, state ordinary income tax, net investment income tax, and depreciation recapture on the sale of Investment property if certain criteria are met including:

posted by: jennifer mussatoJennifer Mussato is president at Denver-based First and Main RE powered by Keller Williams, a real estate group that specializes in commercial leasing, acquisitions, dispositions and investment strategies. Commercial landlords love lease renewals. Just as you use an attorney and accountant for legal and financial matters, always use an expert commercial real estate negotiator that represents your best interests, not your landlord’s, and renegotiate your lease several months before it expires to guarantee the best results.

A proactive approach to a lease renewal is essential for success because time is a powerful negotiating tool. As your lease expiration draws closer, your negotiating leverage diminishes fast. The three biggest, mistakes when renewing or renegotiating a lease are:

Once a landlord believes the tenant is planning to stay, does not have time to move or is prepared to let the landlord’s broker represent them, all negotiating leverage is lost and the landlord is in control. So, even if you plan on renewing your lease, you must find alternatives to your existing lease to show the landlord you have other options and that he could lose you to a competitor. The easiest and most effective way to do this and regain control is to engage a tenant representation broker to represent you on your lease renewal, research other options and create the negotiating leverage and freedom for you to move if you choose to. Besides, your broker will do all the work and they simply share the landlord broker’s fee, which is paid in full whether you are represented or not! We can renew or renegotiate your commercial real estate lease at almost any time and create opportunities for you to benefit from substantially reduced occupancy costs, greater operational efficiency and flexibility to grow or downsize, as well and realigning your real estate with your business plan. Examples of deal points we can negotiate in commercial lease renewals:

Landlords often discourage tenants from seeking tenant representation so they can negotiate higher rents and lease terms that are onerous to the tenant. The landlord’s broker may also discourage you from hiring your own broker so they don’t have to share their fee. Furthermore, lease renewal terms offered to existing tenants are often less attractive as lease terms offered to new tenants. This is because landlords know that a tenant that doesn’t have a tenant representation broker to advise them on the most attractive lease terms achievable is more likely to accept the landlord’s terms and assume they are getting a & fair deal and less likely to take advantage of more beneficial lease opportunities elsewhere. So while you may have a good relationship with your landlord and believe you are getting a great deal on your lease renewal, beware! No matter how good you think your relationship is with your landlord, they are in the business of maximizing their profits by getting the most rent possible, period. Until you create competition for your tenancy and hire an experienced tenant representation broker, your landlord will consider you a captive tenant, willing to pay asking or above-market rents on your lease renewal or renegotiation. Lease renewals and negotiations can be complicated and time consuming. There is much more to negotiate than just the rent. And how do you know you’re getting the most attractive lease terms anyway? Parking charges, operating expense pass throughs and add-ons, security deposits, tenant improvement allowances and endless complicated and misleading lease terms and conditions, with far reaching financial and operational implications, are all up for negotiation. Only with the benefit of a tenant representation broker can you be guaranteed exposure to every opportunity and the negotiating power to secure the best terms available on your lease renewal or renegotiation. At First and Main RE, we manage the entire process from start to finish so you don’t have to, saving you valuable time and money and exposure to risk while you focus on running your business. Our lease renewal process provides you with the strategy, market knowledge and negotiating expertise to guarantee you access to every alternative option available in the marketplace and advise you on the most attractive lease terms achievable on a lease renewal or renegotiation. We audit your lease to determine the options available for reducing your occupancy costs and building flexibility into your lease to achieve your business goals. We then create significant negotiating leverage with your landlord by identifying competitive alternative opportunities to secure the most cost-effective, risk-free lease terms possible on a lease renewal or renegotiation. We do all this in a professional manner that won’t damage your relationship with the landlord.  Commercial real estate leases will introduce you to a whole new set of vocabulary, which can make it difficult to fully interpret documents. To make dissecting the fine print simpler, familiarize yourself with these common terms that you need to know: 1. Right of First Refusal If you a sign a lease that includes a right of first refusal clause, your landlord is required to offer you additional space to lease before offering it to the general public. This gives you the opportunity to lease more office space in an in-demand building if it becomes available and can be highly beneficial if you anticipate major growth in the coming years. 2. Sublease Clause A sublease clause may or may not be included in the contract. This clause either permits or prohibits a tenant from subleasing their space to another individual or business. A sublease occurs when the tenant rents to someone else only a partial amount of time during the remaining time of the lease. Make sure you know if you are permitted to sublease in case an emergency arises. 3. Usable Square Footage The amount of space inside the office or building that you are renting is known as the usable square footage. It is the space that your company is actually occupying within the facility. 4. Rentable Square Footage Rentable square footage includes the usable square footage plus a portion of the square footage that you share with other tenants, such as bathrooms located in hallways, reception areas, on-site gyms, elevators and cafeterias. Landlords base your rental rate on this number, rather than the actual usable square footage in your space. 5. Parking Ratio The parking ratio is the number of parking spaces that are reserved in the lot for your employees. Take the total rentable square footage of your space and divide it by the number of parking spaces. This is usually as a ratio of spaces per 1,000 square feet. 6. Load Factor Also known as the core factor, this number is used by the landlord to determine how much common area square footage to assess to each tenant. Your prospective landlord should be able to explain how this number was calculated, so that you can determine whether or not your rent is being calculated with a fair rentable square footage. 7. Common Area Maintenance Common area maintenance, called CAM for short, refers to the cost of operating expenses for a building that you are responsible for paying a share of with some types of leases. As with load factors, landlords should be transparent about how the common area maintenance fee is calculated and exactly what it covers. 8. Request for Proposal One of the first steps in finding new space to lease is to sit down with your commercial real estate broker and figure out both what you need and what you want in a space. As you find spaces that you think might suit your needs, you can submit those wants and needs in a request for proposal (frequently referred to by its initials -- RFP) document. That RFP lets the landlord know what your general needs are so that they can then begin negotiating with you. Knowing these terms will put you in a better position at the negotiating table, but you should still be prepared to encounter other terms with which you may not be familiar. That's why it's important to have a tenant representative to assist you throughout the process. POSTED BY: JENNIFER MUSSATO

Jennifer Mussato is president at Denver-based First and Main RE powered by Keller Williams, a real estate group that specializes in commercial leasing, acquisitions, dispositions and investment strategies. A deed is a legal instrument, in writing, duly executed and delivered, whereby the owner of real property, otherwise referred to as the grantor, conveys to another, referred to as the grantee, some right, title, or interest in or to the subject of real estate.

GENERAL WARRANTY DEED In a general warranty deed, the grantor guarantees the title to the real property against any defects existing before the grantor acquired title as well as during the time of the grantor's ownership. A general warranty deed conveys both present and after-acquired interest of the grantor. The operative language in a general warranty deed is usually the expanded version, "grants, bargains, sells and conveys"; however only the phrase "sells and conveys" is required by statute. In addition, a general warranty deed will include the phrase "and warrants title to the same" that is short hand for the following covenants:

It is important to note that the above covenants of title, run not only to the benefit of grantee but to all persons down the chain of title from grantee, so that breach of covenants of warranty may be enforced not only by the direct grantee from grantor but also by grantee's successors and heirs. Also, liability of the grantor may be imposed against either the grantor and/or the grantor's heirs. SPECIAL WARRANTY DEED A special warranty deed differs from a general warranty deed in that where a general warranty deed guarantees title against interests predating the grantor's ownership of the property, a special warranty deed merely guarantees title only against defects arising during the time the grantor owned the real property. That is to say, a special warranty deed warrants title as against anyone whose interest has arisen from grantor, but not from others.. Like a general warranty deed a special warranty deed includes after-acquired title. The operative language in a general warranty deed is usually the expanded version, "grants, bargains, sells and conveys"; however only the phrase "sells and conveys" is required by statute. In addition, a special warranty deed will include the phrase "and warrant the title against all persons claiming under me," or an expanded phrase with the same meaning "and warrants title against all claiming by, through, or under me." Using a special warranty deed should be considered when the grantor is willing to warrant against any adverse interest or defect in title which the grantor, herself, created but not against interests of or defects occurring before the grantor was the owner. In essence this deed says, I, as grantor of this property will be responsible and liable for anything I did to the title of the property but not for what others may have done. QUITCLAIM DEED A quitclaim deed is one in which the grantor warrants nothing. This deed conveys whatever interest the grantor has in the property, if any at all. To be clear, a quitclaim deed does not even represent that the grantor has any interest, whatsoever. Unlike both a general warranty deed and a special warranty deed, a quitclaim deed does not convey any after-acquired title. A quitclaim deed uses the operative language "sells and quitclaims." Of note is the absence of the word "conveys' which is present in both a general warranty deed and special warranty deed. A quitclaim deed is generally used where the grantor may or may not have an interest in the property or where the grantor is unwilling to warrant title. Typical types of uses for a quitclaim deed can be to clear title from an interest otherwise affecting marketable title such as interest the grantor may possess through some prescriptive easement in adjacent property.  Calculating how much office space your business needs is not an exact science—though, unfortunately, you may feel the need to come up with an exact number. A real estate broker will often ask you your requirements in terms of square feet, which (s)he uses as a relative measurement of which properties on the market are eligible for consideration. In addition to square footage, (s)he might also ask you for the number of permanent offices or rooms you'll require. AVERAGE SPACE REQUIREMENTS: Space requirements can vary tremendously by company, by industry, and even by geographic area (think space-pressed Manhattan vs. spread-out Houston, for example). And then there's the significant matter of office style. At one end of the spectrum is the open space plan, which has no private offices. Everyone sits together, in one large room, in cubicle clusters or at tables. At the opposite end of the continuum is the traditional hard-wall layout, full of private offices, large conference rooms, and support rooms such as libraries, kitchens, and file rooms. You have to decide what variety of layout suits your business best: open space, closed space, or a combination of both. The estimates provided below are average space requirements—the number of square feet per person or function that's typical at most companies. Consider them rules of thumb. Each can be individually adjusted upward to provide a more spacious layout or downward to provide a more efficient use of office space. Employees Requiring Offices:

Employees Requiring Cubicles:

Employees in an Open Area:

Permanent Rooms and Spaces:

Don't forget to think of other specialty areas particular to your operations. If you have advanced technological needs, you might require a room for computers or servers, for example. COST DETERMINATIONS: Ask your real estate broker how much the space costs per square foot. This could help you determine your most important needs, and make sure the space where you desire to re-establish your business is also cost-effective. Don't forget that you will be purchasing or signing a lease that will lock you into this office space for at least two to five years. Therefore, add 10 percent to 20 percent to the total square footage that you calculated to accommodate future growth. Remember that the additional expense of terminating a lease early and the cost of moving an office after only a short period of time will be more than offset by having this additional space in reserve waiting to be used. posted by: Jennifer mussatoJennifer Mussato is president at Denver-based First and Main RE powered by Keller Williams, a real estate group that specializes in commercial leasing, acquisitions, dispositions and investment strategies.  Investors who have commercial properties they wish to acquire or dispose, landlords seeking tenants to lease space in the commercial properties they own, and tenants seeking to lease space in a commercial property, all hire a commercial real estate Broker. So, how does a commercial real estate Broker get paid…and who pays them? Commercial Real Estate Brokers Get Paid on Commission. All commercial real estate brokers get paid on commission based on the representation of the two parties in a transaction. In a sale transaction this would be the buyer and seller, and in a lease transaction this would be the landlord/owner and the tenant. The amount a commercial real estate Broker receives on a commission is calculated as a percentage of the total commercial property sale price or lease value. While it’s illegal due to anti-trust laws to set a market- or industry-wide standard for commission percentages, most Brokers earn anywhere from 4% to 8%. The manner in which a CRE Broker is paid, and who is responsible for the payment, depends on whether the commercial transaction is a sale or a lease. Commission on Commercial Real Estate Sales: Commercial real estate Brokers receive a commission on the sale of a commercial property by representing an owner, a buyer, or both. The amount of the commission is calculated as a percentage of the final sale amount. If there are two different Agents involved in the transaction they will split the commission 50/50. For example, say the negotiated commission rate on a commercial property is 6% and it sells for $600,000, that is $36,000 is commission. The full $36,000 will go to the listing Broker (representing the owner) if they are the one who procured the buyer. If another commercial real estate Broker brought the buyer, then the two Brokers would split the commission 50/50 each earning $18,000 on the deal. In most commercial real estate sale transactions it is the responsibility of the property owner to pay all commissions upon closing. Commission on Commercial Real Estate Leases: Commercial real estate Brokers receive a commission on lease transaction by representing a landlord/owner, a tenant, or both. The amount of the commission is calculated as a percentage of the total lease value, also called total consideration. If there are two different Brokers involved in the transaction they will typically split the commission 50/50. This is, unless otherwise noted in the lease agreement. For example, say a tenant signs a 5-year lease for a 3,500 square foot suite at $10 per square foot. 5 years x (3,500 SF x $10) = $175,000 Total Lease Value If the negotiated rate is 6%, the total commission on this lease will be $10,500 ($175,000 x 6%). If there were two commercial real estate Brokers on the deal (one representing the landlord/owner and one representing the tenant) then each broker will earn $5,250 ($10,500./ 2). In leasing transactions the landlord/owner of the commercial property is the one who pays the commission fee. Typically, half at lease signing and the remaining half upon tenant occupancy. Seeking a Commercial Real Estate Broker? Whether seeking to invest in properties, dispose of current assets, lease up your building, or find space to lease, the brokerage experts at First and Main RE have the transactional experience and market knowledge to get you the best deal possible. Contact us today to see how we can help you see the highest return on your investment. Posted by: Jennifer MussatoJennifer Mussato is president at Denver-based First and Main RE powered by Keller Williams, a real estate group that specializes in commercial leasing, acquisitions, dispositions and investment strategies. 1. Price-to-Rent Ratio Generally you want to meet 1% or better. Meaning if a property costs $150K then the rent should be $1,500 or more. When you factor in carry costs, etc., 1% is a general threshold between cash flowing positive or negative. Be sure to still run the full financials through a property calculator for a clear picture of your potential returns. However, the 1% rule is a good guide for a quick, offhand calculation when need be. 2. Keeping Maintenance Costs Low How exactly do we do this? I mean stuff breaks, right? When acquiring property the goal is to find one where high cost items still have a long shelf life. Otherwise, pricing the replacement of them into your offer is prudent. Items such as:

Setting aside a portion of rents as reserves for large replacement costs is part of being a good property investor. However, those reserves need some time to build up. If your HVAC unit dies in year one – your profits just took a big hit. 3. Good Schools For my investing goals – properties in good school districts are beneficial because rental demand for two and three-bedroom townhomes largely come from new families with young children. Having a rental property in a good school district sets you apart from the pack in their eyes. Plus, good schools usually go hand-in-hand with good neighborhoods. On the flip side, if you are investing in two-bedroom condos near a downtown city center then school districts really don’t have as much bearing. Thus, know what your investing goals are and act accordingly. 4. Listings & Vacancies In the end, we must be able to fill our rental property for it to make a good investment. Always make sure to check the current listing of the neighborhood or community you are looking to purchase in. How many properties are listed for rent and what is the average days on market? If a bunch of available properties are sitting on the market for a few months - you now know renting out a property in that area will be more difficult and the chance of vacancies is higher. Posted by: Jennifer mussatoJennifer Mussato is president at Denver-based First and Main RE powered by Keller Williams, a real estate group that specializes in commercial leasing, acquisitions, dispositions and investment strategies. A modified gross lease is a type of real estate rental agreement where the tenant pays base rent at the lease's inception but in subsequent years pays the base plus a proportional share of some of the other costs associated with the property, such as property taxes, utilities, insurance and maintenance. For example, under a modified gross lease, a property's tenants might be required to pay their proportional share of an office tower's total heating expense. Breaking Down Modified Gross Lease - Commercial real estate leases can be categorized by two rent calculation methods: ‘gross" and ‘net’. The modified gross lease - at times referred to as a modified net lease - is a combination of a gross lease and a net lease. Under a gross lease, the owner/landlord covers all the property’s operating expenses including real estate taxes, property insurance, structural and exterior maintenance and repairs, common area maintenance and repairs, unit maintenance and repairs, utilities and janitorial costs. A net lease, which is more common in single-tenant buildings, passes the responsibility of property expenses through to the tenant. Net leases would most likely be used in conjunction with large single tenant properties such as national restaurant chains. Modified gross leases are a hybrid of these two leases as the operating expenses are both the landlord and tenant's responsibility. With a modified gross lease, the tenant takes over expenses that are directly related to his or her unit, including unit maintenance and repairs, utilities and janitorial costs, while the owner/landlord continues to pay for the other operating expenses. The extent of each party’s responsibility is negotiated in the terms of the lease. Which expenses the tenant is responsible for can vary significantly from property to property, so a prospective tenant must ensure that a modified gross lease clearly defines which expenses is the tenant’s responsibility. When Modified Gross Leases are Common - Modified gross leases are common when multiple tenants occupy an office building. In a building with a single meter where the monthly electric bill is $1,000, the cost would be split evenly between the tenants; if there are currently 10 renters, they each would pay $100. Or, each tenant might pay a proportional share of the electric bill based on the percentage of the building’s total square footage that the tenant’s unit occupies. Alternatively, if each unit has its own meter, each tenant will pay the exact electrical expenses it incurs, whether $50 or $200. At First & Main, we're experienced in all phases of lease negotiation and renegotiation. We know what to look for and how to protect you from potential pitfalls. Remember, there is never a cost to the lessee in a lease negotiation! And we're happy to review even existing leases to advise you how to handle renewals  Multiple studies have confirmed the medicinal benefits of marijuana, but what about its impact on the health of the housing market? Does medical and recreational legalization lead to growth in home values or is the pot industry just blowing smoke? This past year, voters in California, Massachusetts, Maine, and Nevada all legalized recreational use while Florida, Arkansas, North Dakota, and Montana voted to legalize or expand medical use in those states. One thing is clear, pot entrepreneurs are contributing to real estate booms in commercial and residential markets in states that have legalized the drug for medical recreational use. Impact on Commercial Sales: Previously vacant warehouses and factories are now home to growers while long-abandoned strip malls have become the storefront for pot shops. The pot industry has created a huge demand for commercial operations. As a result, states like Colorado and Washington are seeing premium prices for building leases and purchases within the proper zoning. Buying real estate is an attractive asset to marijuana growers and retailers because it provides a safe haven for their profits that many banks are still reluctant to manage due to federal regulations and give them more freedom to create specialized spaces for their business. Landlords also notoriously price gouge marijuana tenants, so buying makes good business sense over renting. Successful owners of marijuana businesses quickly turn to real estate and become landlords themselves. In Colorado, Polk and Stone rents properties to marijuana businesses with the agreement that rent will increase only 3 percent a year. In an industry where rent can increase by 50 percent from year to year, this business model is enticing to marijuana entrepreneurs. Impact on residential sales: Colorado's state law allows for counties to determine if they and how they want to legalize and regulate the drug. Areas where it’s legal attract more homebuyers, including marijuana users as well as entrepreneurs and job seekers. As more growers and retailers open up shop in these municipalities, the demand for workers rise. The influx of new residents inevitably leads to more home sales and higher rents. There are also plenty of people moving to pot-friendly states without intent to work for the industry, but rather to enjoy the bud of its labor. Impact on home values: Realtor.com reports the four states with at least a year of experience with recreational marijuana sales showed a marked increase in home prices — well above the national median price. The data from Colorado provides some of the best insights on what happens to the housing market after recreational use is legalized because it has permitted its use the longest. Since the first shops started operations on January 1st, 2014, the median home sale price in the state has risen from $248,000 in the first half of 2014 to $298,000 in the first half of 2016 according to the realtor.com analysis. In jurisdictions where the drug can be purchased, the median sales price of homes in the second quarter of 2016 were a hit $305,200 while homes in areas where it is banned only went for $267,200. Of course, there are other industry sectors that have been experiencing rapid growth in Colorado, so it’s difficult to contribute the rise in home prices strictly to the rising business of pot, but it's an obvious leading contributor. Unfortunately, not every homeowner in states with legalized weed is getting a good deal. On the flip side, Colorado neighborhoods harboring grow houses lose value. The pungent odor the plant emits turns off home seekers. Concern for criminal activity: One of the greatest concerns of detractors of legalization is the claim it will encourage more crime and further reduce home values of those living near grower, manufacturers, and retailers. Looking to Colorado again, in Denver, the crime has grown by 44% as reported to the National Incident Based Reporting System since legalization. But police argue that the system potentially over counts crimes and prefer to cite the FBI's Uniform Crime Report which indicates only a 3.5% increase over the same time. It's important to note, however, the city began tracking marijuana-related crimes as well, which make up less than 1% of all offenses. Experts conclude that the rise in crime is tempered when taking population growth into account, and not directly tied to the sale or use of the drug. Dealing with real estate transactions: From a real estate professional perspective, a lingering question is how to deal with money that comes from an industry that is still federally prohibited under the Controlled Substance Act. There is a serious lack of banking services for commercial operations in the medical and recreational marijuana business. Although many title companies will help close on a cannabis deal, they will not facilitate the exchange of funds. That's because banks refuse to work even indirectly with marijuana business owners. As a result, title companies have formal policies against serving as escrow, especially when the land is designated for pot-related use, but will issue limited title insurance policies on the land that won't cover federal governmental actions such as civil and criminal forfeiture. As more states pass legalization, this will provide opportunities for agile and creative real estate brokers to provide much needed professional guidance for marijuana business owners. Written by Amanda Farrell, ProplogixThe purchase, sale, funding or even leasing options for commercial property often hinge upon the appraised value of the building. Assessing that value, however, is no simple matter. Whether it’s multi-unit housing, an industrial space, a retail shopping center, or an owner-occupied business structure, commercial appraisals are generally more subjective than residential valuations.

Why? Commercial values are often dependent upon uncontrollable elements like the current market price for which spaces rent, fewer available comparables and overall maintenance costs (which can vary dramatically from industry to industry). And then, of course, there’s the tricky question of how much a buyer is willing to pay. With so many variables to consider, how does an investor or small business owner price a potential property? There are five valuation methods often used to determine intrinsic value. Cost Approach: This valuation method considers the cost to rebuild the structure from the ground up, taking into account the current cost of associated land, construction materials, and other costs that would be associated with the replacement of the existing structure. Cost approach is generally applied when appropriate comparables are difficult to locate, such as when the property contains relatively unique or specialized improvements, or when upgraded structures have added substantial value to the underlying land. Sales Comparison Approach: Also known as the “market approach,” this method relies heavily upon recent sales data for comparable properties. By seeking recently sold buildings with similar properties from the same market area, a buyer hopes to ascertain a fair market value for the property in question. For example, an office complex might be compared to another that sold in the same neighborhood just a few months earlier. While this valuation method is typically used to value residential real estate, it does have one significant drawback. Depending on general and localized market conditions, it can be difficult to find recent comps that have similar properties. Income Capitalization Approach: This valuation method is based primarily on the amount of income an investor can expect to derive from a particular property. That projected income could be derived in part from a comparison of other similar local properties, as well as from an expected decrease in maintenance costs. Say a building is purchased for $1 million, and the expected yield is 5 percent, based on local market research. That $50,000 per year in expected income could be enhanced by tightening inefficiencies, or by passing along other associated costs to the tenant, like electric or water usage. All expected future income is discounted to reflect present value. Value Per Gross Rent Multiplier: The Gross Rent Multiplier (GRM) is a calculation used to measure and compare a property’s potential valuation by taking the price of the property and dividing it by its gross income. This method is generally used to identify properties with a low price relative to their market-based potential income. Value Per Door: Occasionally used to value apartment buildings, this valuation method breaks down the building’s worth by the number of units. A building with 20 apartments priced at $4 million, for example, would be valued at $200,000 ‘per door’ irrespective of each unit’s size. In the end, every buyer values property differently. The valuation of commercial property does have a subjective and unscientific component. The best commercial real estate investors and brokers have honed their gut instincts around finding the most attractive deals, and the most effective valuation methods for each particular type of transaction. At the end of the day, no matter how much analysis has been conducted, the value of commercial real estate is always in the eye of the beholder. The final post of this series on land buyer due diligence focuses on physical attributes that can significantly influence property value. Please keep in mind that this is only a primer for buyers of land for sale, to assist them in identifying a property.

Soils Outside of forestry and agricultural circles, soil is perhaps the most under-appreciated and misunderstood factor in successfully growing and managing a healthy crop.. Understanding the various soil types, specifically their capacity to retain or hold water, is an important consideration when developing long-term forestry plans. To learn more about soils and their importance to forest health, there is no better source than the USDA Natural Resource Conservation Service. While you’re there, check out the “Soil Survey” section, which provides a process to access published soil data to create a detailed soil map of the parcel of interest. Water: Many buyers seeking recreational land for sale desire some type of water body. Some seek ponds, lakefront, rivers or even open water wetlands. While we often chuckle when we read “babbling brook!” in the property description, real estate agents are simply appealing to market demand. Given a choice between land with no water and land with a small brook, buyers will often gravitate to the latter when all other aspects are relatively equal. Regardless of the water body type or size, it’s a good idea to consider the surrounding land use patterns to determine what “upstream” activities may impact water quality. Using Google Earth Maps, study the surrounding topography contributing to the water body on the parcel of interest. Ask the broker or the seller about the land use history of the parcel. If it’s a large parcel (>100 acres) consider conducting a Phase I Environmental Site Assessment (ESA), a visual site inspection conducted by a licensed environmental consulting firm to identify any prior or present evidence of hazardous contamination. Part of a Phase I ESA includes a voluntary interview with the landowner to document what they know about the past land uses of the property. If forestry is the primary use, understand the buffer zone laws and setback distances from various water bodies for forestry activity. Consider timber retention in these areas as part of your forest management plan. If fishing is a passion, then you will want to know the native fish populations and fishing regulations. Is it a warm water fishery hosting bass, perch and pickerel or a cold water fishery hosting trout and land-locked salmon? Some states, have historical lake and pond surveys that offer the water depth, type of fishery and stocking status. These surveys are often dated (>10 years old) but still offer useful information for avid anglers. Written by Patrick Hackley, a professional forester and timberland broker with Fountains Land who has served timberland owners and buyers in the northeast since 2005. Last month, we began a series of posts on what land buyers should consider before purchasing land (see Land Buyers Checklist: Part I – Due Diligence). Remember that we call the research to ensure that a property satisfies all of the buyer’s criteria “due diligence.” Last time, we discussed due diligence on access, boundaries and deeds. Today, we’re on to the next group of considerations.

Location: The location of the land for sale is an important consideration. The owner’s primary use, whether it’s for investment, recreation, a second home, or a blend of these uses, will dictate where the property is located. For those seeking a recreational get-away that can be visited on the weekends, many buyers try to limit the travel time to about a half day’s drive. That way, one can sneak out of work on a Friday afternoon, drive about four hours, and be grilling steaks by dinner time. Other buyers, seeking more remote retreats, may only need to have a local airport within an hour of the property with someone local to drive them the rest of the way. Keep in mind that “remote” has many meanings and is sometimes more of a feeling than an actual geographic location. Timberland investors who may need to visit the property once a year can acquire tracts in any part of the country or even abroad. While the actual location may not matter for timberland investments, there are three important location related attributes that timberland investors must consider: 1) a good road system for hauling forest products; 2) a variety of wood markets within the region; and 3) availability of forestry services and an established logging and trucking workforce. State & Municipal Regulations: Imagine that you are fortunate enough to find your piece of paradise. You have established that you have good access, you know the acreage and you have reviewed the deed. However, will your desired use be compatible with town or state regulations? If the intention is to build a year-round dwelling, then it’s important to first confirm the municipal requirements for road frontage on a publicly-maintained road. If there is no road frontage, some towns will allow building on unmaintained roads; however, they will require the owner to sign a liability waiver if town vehicles are unable to access the dwelling in an emergency. If the intention is primarily forest land management, then knowledge of town and/or state forestry laws is necessary. Each state has its own set of laws, some more restrictive than others, relative to harvesting limits, water quality and wildlife habitat protection. Adherence to certain forestry practices is required to qualify for discounted tax programs. Consult with a local forester to understand these laws and determine if the regulatory climate in that state will be compatible with your long-term goals before acquiring the property. If the intention is to eventually sub-divide the property, check the deed (again) to ensure that there are no restrictions limiting subdivision. Next, review the town zoning ordinance and site plan review process to understand what is required for a subdivision proposal. In many small rural towns, there are no formal zoning ordinances, only minimal requirements for building lot size and road frontage. However, never assume this! Always contact the town directly to inquire about their zoning and planning process or any statewide regulations that the town may have adopted into their ordinances. If you are considering energy generation, wind or solar, or communications towers, this will undoubtedly trigger a unique set of regulations. You should be prepared to hire a land-use attorney experienced in the permitting process for these projects. Taxes: Fortunately, landowners of ten to twenty-five acres or more in New England and New York qualify for a discounted property tax rate for maintaining some or all of their land in an undeveloped condition. These laws are often referred to as “current use” laws because the tax rate is based on its current use (agriculture, forests, pasture, wetland, etc.) rather than their potential use to support development (residential or commercial uses). A major premise of these laws acknowledges that undeveloped land provides inherent values to society (open space, clean water, wildlife habitat, and recreation) while requiring little to no municipal services. Therefore, a lower tax rate allows these landowners to maintain their land in an undeveloped condition rather than be forced to sell due to escalating taxes. Each state administers their respective current use programs differently so contact the state revenue agency to obtain and understand the enrollment criteria as part of your due diligence. Federal Income Tax: Timber income is subject to federal income taxes. There are a significant number of ways to reduce your tax exposure. Keeping excellent records from the very start of your due diligence process is one way. For a thorough overview in managing federal timber taxes, visit the National Timber Tax Website. Ben Franklin famously quipped, “Nothing can be said to be certain, except death and taxes.” Understanding your tax obligations on the local, state and federal levels prior to acquisition will go a long way in helping you manage your land investment wisely, just like old Ben. Written by Patrick Hackley, a professional forester and timberland broker with Fountains Land who has served timberland owners and buyers in the northeast since 2005. Owning a parcel of land is the dream of many. Whether it’s ten acres or several thousand, land ownership represents an investment in a solid, tangible asset – one that holds intrinsic value to the owner and signifies means and permanence in society.

In order to ensure that the land for sale provides the enjoyment and utility that the buyer is seeking, it is critical to thoroughly research the property before entering negotiations to purchase. We call this due diligence – that is, ensuring the property satisfies all of the buyer’s criteria. So, what should a prospective buyer consider? The following is the first of a three-part list of key items with a brief primer to get one started on the due diligence process. Access: This is perhaps the most critical characteristic influencing value. The nature and extent of access dictates the type of uses the parcel can offer. Does the parcel front a publicly-maintained road with power and utilities? Does the parcel have a deeded right-of-way across an adjacent landowner? Does the condition of the road surface (e.g. gravel vs. pavement) relegate it to seasonal or year-round use? Research the access thoroughly and understand all the associated benefits and limitations to be sure you can use the parcel as you envision. Boundaries: Parcel boundary markings exist in many forms and, in some cases, not at all Always inquire first if a survey exists. It doesn’t necessarily have to be registered at the county registry of deeds, but it must have the imprint of a licensed surveyor to be legitimate. If no survey exists, start with the deed description and obtain a copy of the town assessor map. However, beware of the latter source as most municipal assessor maps are meant for general location reference and not boundary identification. When physical evidence and legal documentation is lacking or uncertain, a licensed surveyor may be necessary to locate and re-mark the boundaries. Don’t be afraid to engage a professional to help you ascertain the parcel boundaries. It will be money well spent. Deeds: A registered deed is the most important document to review. The seller or his/her broker can provide you with a copy. In some cases, you may need to obtain one from the town or country registry of deeds. Many registries are on-line and one can easily download copies of the deed, sometimes for a nominal fee. The deed confirms the owner’s identity, who they purchased it from, and when. Most importantly, it provides a physical description of the property, and references any encumbrances or exclusionary rights of other parties – e.g. “excepting and reserving a 50’ right-of-way to Edna Johnson, her heirs and assigns, to access her property…” Other encumbrances may include water rights held by an adjacent landowner to a natural spring on the subject property. Likewise, there can also be mineral rights, timber rights, gravel rights or a camp right held by another person or entity. In some cases, these rights can be extinguished by negotiation with the third party. Read the deed carefully – more than once – and understand what is for sale, where it’s located, and any encumbrances that may exist. It is strongly advised that an attorney review the deed prior to sale, often done as a contract contingency, and that they conduct a thorough title search to ensure a “clean, marketable” title. There is no substitute for sound legal review in the acquisition process. Written by Patrick Hackley, a professional forester and timberland broker with Fountains Land who has served timberland owners and buyers in the northeast since 2005. The letters “NNN” sometimes strike fear in those renting space. A NNN lease, also known as a net-net-net or triple net lease, is a type of real estate lease that requires the tenant to pay, in addition to rent, all of the property's associated costs. The three nets in a triple net lease are real estate taxes, property insurance and maintenance costs. Because the landlord shifts these extra costs to the tenant, the rent he charges for a triple net lease is almost always less than for a comparable lease in which the landlord assumes these costs.

Benefits to Landlords: Any type of real estate transaction can utilize a triple net lease. This includes residential, commercial and industrial real estate. That said, this type of lease is used most often in commercial real estate transactions, particularly ones involving freestanding buildings. Many large companies that operate under the franchise model, such as McDonald's, lease buildings to their franchisees under the triple net structure. Companies that make money by investing in and leasing out multi-million dollar commercial properties often cannot be bothered with keeping up with things such as maintenance. They circumvent that responsibility by lowering the rent and shifting the extra costs associated with the building to the tenant. Triple net leases are also gaining popularity in residential real estate. In snatching up inexpensive properties in the wake of the 2007-2008 financial crisis and turning them into rentals, many investors find they do not enjoy dealing with maintenance and insurance issues any more than larger commercial investors enjoy these issues. As a result, they are taking a page from the commercial playbook and passing those costs to tenants by way of triple net leases. At First & Main, we're experienced in all phases of lease negotiation and renegotiation. We know what to look for and how to protect you from potential pitfalls. Remember, there is never a cost to the lessee in a lease negotiation! And we're happy to review even existing leases to advise you how to handle renewals Land surveys are an important but often overlooked part of real estate due diligence. Sometimes a lender will require some type of survey or certificate from a surveyor before a title company issues a lender’s title insurance policy, but that’s not the case everywhere. Often, the survey used in a new real estate transaction is an old one conveyed by the seller. Whether you're a real estate agent, investor or a savvy buyer who's been through a closing, you've probably heard this before. While this may be an acceptable standard in the real estate and title industry in certain regions, it’s not ideal for a new homeowner and could cause major problems for the buyer in the future.

Below is excerpts from an interview between Amanda Farrell with PropLogix and Akkad Bakhsh with First Choice Surveying to give more details on why a survey is so important to the investment experience. 1. What is the worst advice you’ve heard about land surveys? That a new survey is not needed if an old survey can be provided. 2. Is there any new technology in the industry changing the way you do surveys? GPS and drone surveying are making a huge impact on the accuracy and speed of conducting a survey. 3. What is the most important thing for home buyers to know about land surveys when looking for a home? Always order a survey, even when the current sellers have one. A seller could say they didn’t make any changes to the property and sign a document saying that but the problem is if a neighbor makes a change to their property. For example, the neighbor may build a concrete slab that encroaches slightly onto your property and if somebody happens to fall on that concrete slab that is partially on your property, you are now liable to for any injuries to that person. In my opinion, it’s always best to get a new survey that is certified to the current buyer. 4. How many hours does it usually take to conduct a standard survey? This is a difficult question to answer because surveys require different phases and time in between each phase to get completed. If I had to give it an hourly breakdown I would estimate 5-8 hours, spread over multiple days. 5. What was the most difficult survey you've done? One that comes to mind recently was a commercial lot where we could not find any control points or corners. There was absolutely nothing on the property that could help us create the survey. We worked on it a for a week and had to go back to the client and tell them we couldn’t complete the survey. That was the only time that we have been unable to figure out a boundary on a property. 6. What are some common misconceptions about land surveys? Again, that a new survey is not needed when an old one is provided. The corners in the ground are always correct. Sometimes, those corners can be pulled up and moved. This can be corrected, but it takes additional detective work and creative problem-solving. The fee for a survey should be the same on all properties that are the same size. The size of the property doesn't always dictate the difficulty of completing a survey. Land, especially un-development or under-development land, isn't all the same. Finding corners in a rural parcel that might be small won't be as easy as a completing a survey in a PUD (Planned Unit Development). Still think you don't need a survey? It's common in the real estate industry to suggest that the buyer use the old survey from the seller because a new survey may seem like an unnecessary cost, but this is a common misconception with potential for massive disappointment for the new owner. Even though a survey isn't required by every state or lender, the value of a survey is evident. Is saving a few hundred dollars on one of the biggest investments you will ever make really worth taking that kind of risk? Amenities: Check the potential neighborhood for current or projected parks, malls, gyms, movie theaters, public transport hubs and all the other perks that attract renters. Cities, and sometimes even particular areas of a city, have loads of promotional literature that will give you an idea of where the best blend of public amenities and private property can be found.

Building Permits and Future Development: The municipal planning department will have information on all the new development that is coming or has been zoned into the area. If there are many new condos, business parks or malls going up in your area, it is probably a good growth area. However, watch out for new developments that could hurt the price of surrounding properties by, for example, causing the loss of an activity-friendly green space. The additional condos and/or new housing could also provide competition for your renters, so be aware of that possibility. Number of Listings and Vacancies: If there is an unusually high number of listings for one particular neighborhood, this can either signal a seasonal cycle or a neighborhood that has "gone bad." Make sure you figure out which it is before you buy in. You should also determine whether you can cover for any seasonal fluctuations in vacancies. Similar to listings, the vacancy rates will give you an idea of how successful you will be at attracting tenants. High vacancy rates force landlords to lower rents in order to snap up tenants. Low vacancy rates allow landlords to raise rental rates. Rents: Rental income will be the bread and butter of your rental property, so you need to know what the average rent in the area is. If charging the average rent is not going to be enough to cover your mortgage payment, taxes and other expenses, then you have to keep looking. Be sure to research the area well enough to gauge where the area will be headed in the next five years. If you can afford the area now, but major improvements are in store and property taxes are expected to increase, then what could be affordable now may mean bankruptcy later. Natural Disasters: Insurance is another expense that you will have to subtract from your returns, so it is good to know just how much you will need to carry. If an area is prone to earthquakes or flooding, paying for the extra insurance can eat away at your rental income. The team at First and Main have helped many new and veteran landlords find their new profitable real estate investment. Call us today! Rental properties, whether single family or multi-family can be an amazing and profitable investment. But for the best returns, do your research going in.

Neighborhood: The quality of the neighborhood in which you buy will influence both the types of tenants you attract and how often you face vacancies. For example, if you buy in a neighborhood near a university, the chances are that your pool of potential tenants will be mainly made up of students and that you will face vacancies on a fairly regular basis (during summer, when students tend to return back home). Property Taxes: Property taxes are not standard across the board and, as an investor planning to make money from rent, you want to be aware of how much you will be losing to taxes. High property taxes may not always be a bad thing if the neighborhood is an excellent place for long-term tenants, but the two do not necessarily go hand in hand. The town's assessment office will have all the tax information on file or you can talk to homeowners within the community. Schools: Your tenants may have or be planning to have children, so they will need a place near a decent school. When you have found a good property near a school, you will want to check the quality of the school as this can affect the value of your investment. If the school has a poor reputation, prices will reflect your property's value poorly. Although you will be mostly concerned about the monthly cash flow, the overall value of your rental property comes in to play when you eventually sell it. Crime: No one wants to live next door to a hot spot for criminal activity. Go to the police or the public library for accurate crime statistics for various neighborhoods, rather than asking the homeowner who is hoping to sell the house to you. Items to look for are vandalism rates, serious crimes, petty crimes and recent activity (growth or slow down). You might also want to ask about the frequency of police presence in your neighborhood. Job Market: Locations with growing employment opportunities tend to attract more people – meaning more tenants. To find out how a particular area rates, go directly to the U.S. Bureau of Labor Statistics or to your local library. If you notice an announcement for a new major company moving to the area, you can rest assured that workers will flock to the area. However, this may cause house prices to react (either negatively or positively) depending on the corporation moving in. The fallback point here is that if you would like the new corporation in your backyard, your renters probably will too. Ask any real estate professional about the benefits of investing in commercial property, and you'll likely trigger a monologue on how such properties are a better deal than residential real estate. Commercial property owners love the additional cash flow, the beneficial economies of scale, the relatively open playing field, the abundant market for good, affordable property managers and the bigger payoff from commercial real estate.

But how do you evaluate the best properties? And what separates the great deals from the duds? To be a player in commercial real estate, learn to think like a professional. For example, know that commercial property is valued differently than residential property. Income on commercial real estate is directly related to its usable square footage. That's not the case with individual homes. You'll also see a bigger cash flow with commercial property. The math is simple: you'll earn more income on multifamily dwellings, for instance, than on a single-family home. Know also that commercial property leases are longer than on single-family residences. That paves the way for greater cash flow. Lastly, if you're in a tighter credit environment, make sure to come knocking with cash in hand. Commercial property lenders like to see at least 30% down before they'll give a loan the green light. The best way to find the most profitable investments? Hire an experienced agent. Give us a call. We just happen to know a few. |

6300 S Syracuse Way, Suite 150

Greenwood Village, CO 80111

(303) 887-9893

Each office is independently owned and operated.

RSS Feed

RSS Feed